Robinhood (HOOD) is sending off a Money Card and betting on purchaser spending patterns to open its next learning experience.

For every exchange, Robinhood Money Card clients can choose whether to gather together their change to the closest dollar when they create buys and they can then pick a speculation resource for direct their loose coinage to.

“The cutting edge has an exorbitant premium in money management, yet it is far off for some since they’re up to speed in the pattern of expenditure” Robinhood Boss Item Official Aparna Chennapragada told Hurray Money. “Thus we constructed this spending account and a money card … to have the option to transform spending into money management.”

As the economy keeps on resuming following the profundities of the Coronavirus pandemic, spending is expected to drift higher even in the midst of multi-decade high expansion. An expansion in spending among cardholders would then give Robinhood really exchanging volume as shoppers decide to utilize their change from buys to put resources into values or digital money.

Robinhood focuses on existing miniature financial planning class pioneers like Oak seeds and Reserve — which are both unicorn privately owned businesses esteemed at more than $1 billion which have focused on reasonable market passage and contributing by utilizing spare change.

The Money Card likewise inclines toward digital currency reception. Market orders on Robinhood can be set for what might be compared to nickels and dimes, so loose coinage can be placed into computerized coins, a moderately inactive passage point contrasted with saving to buy bitcoin or ethereum.

“At the point when we do the client research, we see a charge [card] essential [users], youthful, up and coming age of clients who are keen on money management and inquisitive about crypto, yet they won’t go through constantly remembering hexadecimal spells, and I think for them crypto is as yet unavailable” said Chennapragada.

During 2021, crypto resources under authority on Robinhood expanded 528% to $22.1 billion. Exchanges income from digital money have demonstrated to waiver on a consecutive premise during additional unpredictable periods.

The organization intends to carry out the Money Card item to a shortlist first, with an information survey period to measure revenue, and furthermore to decide whether cardholders favor a computerized wallet card or an actual card.

Global Ladies’ Day Nasdaq President Adena Friedman on propelling ladies to the C-suite

Global Ladies’ Day Nasdaq President Adena Friedman on propelling ladies to the C-suite  Why Dallas Ranchers Lobby of Notoriety QB Troy Aikman is taking on Enormous Brew

Why Dallas Ranchers Lobby of Notoriety QB Troy Aikman is taking on Enormous Brew  Young ladies Who Code pioneer ‘Working environments have never been worked for ladies’

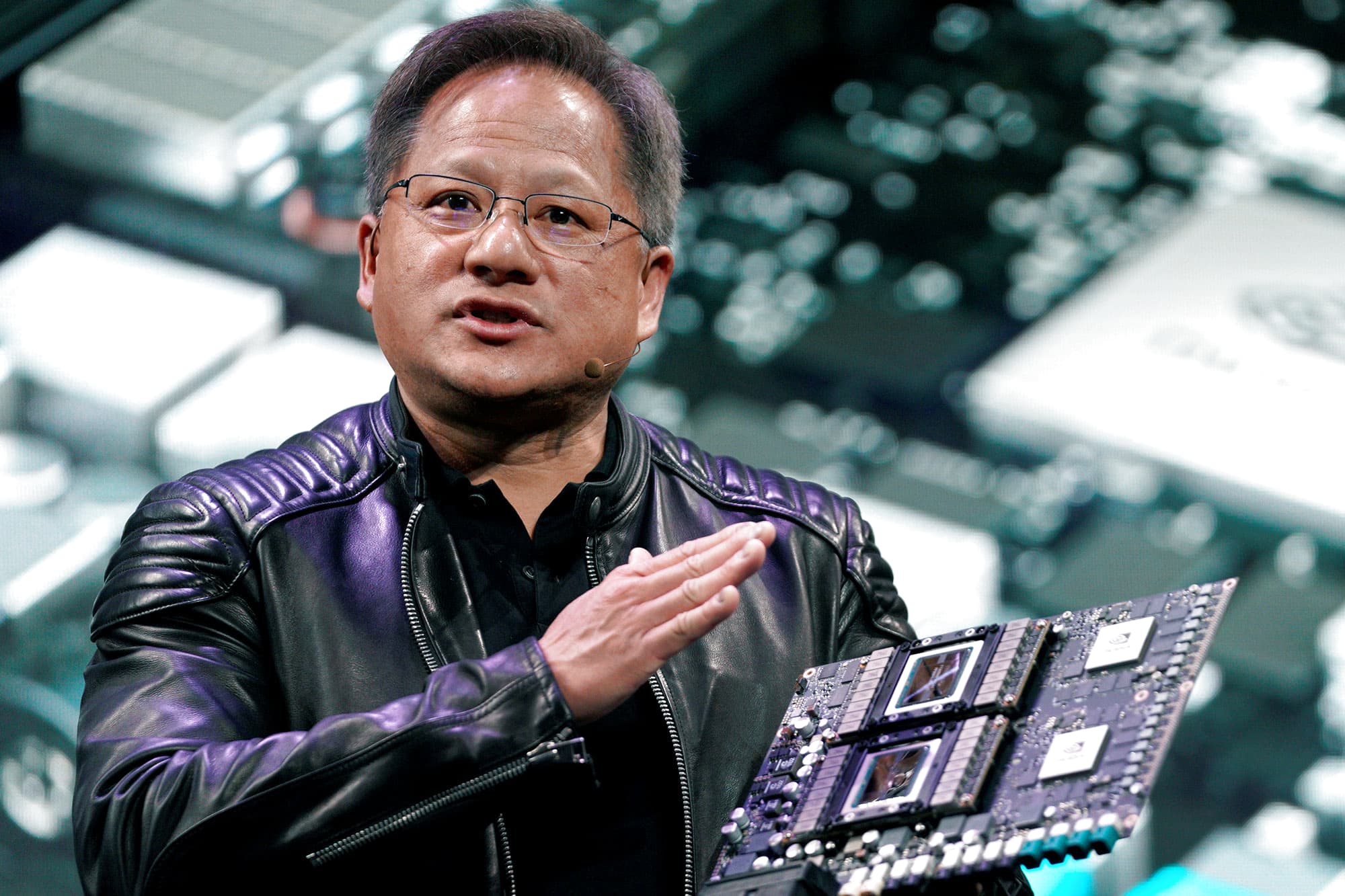

Young ladies Who Code pioneer ‘Working environments have never been worked for ladies’  Why Nvidia’s Chief sees auto chips and tech as the organization’s next huge business

Why Nvidia’s Chief sees auto chips and tech as the organization’s next huge business  Nvidia President Jensen Huang Our Effortlessness computer chip

Nvidia President Jensen Huang Our Effortlessness computer chip  Contributing legend Bill Gross AMC and GameStop stocks resemble lottery tickets

Contributing legend Bill Gross AMC and GameStop stocks resemble lottery tickets