Unbelievable financial backer and Berkshire Hathaway (BRK-A, BRK-B) President Warren Buffett might be feeling the loss of some things on cryptographic forms of money, contends LinkedIn Pioneer and noted investor Reid Hoffman.

“Warren’s contention that look, they’re not useful and not generative,” Hoffman said in another episode of Yippee Money Presents (video above). “Warren doesn’t comprehend the sort of tech stages and what sorts of things could be valuable for a worldwide character framework that could be stuffed into a conveyed record that is important for web conventions, or records for resources that you could have as a component of you doing various applications, etc.”

Hoffman went onto acclaim Buffett’s effective money management sharpness in accordance with putting resources into genuine organizations.

Buffett and his long-term righthand man at Berkshire Hathaway Charlie Munger aren’t excessively far taken out from destroying digital currencies for the umpteenth time.

“In the event that you possessed all of the bitcoin on the planet and you offered it to me for $25, I wouldn’t take it,” Buffett said at the Berkshire Hathaway yearly gathering on April 30. “Since how might I manage it? I’ll need to sell it back to you somehow. Doing anything isn’t going.”

Buffett broadly called bitcoin “rodent poison squared” at the organization’s 2018 yearly gathering.

Undoubtedly, one perspective that both Buffett and crypto allies, for example, Hoffman could settle on is that the market costs for the innovation are exceptionally unstable. Furthermore, that unpredictability storm long inborn to the crypto fix is current back in full power.

Numerous cryptographic money costs are plunging in the midst of a more extensive defeat in unsafe region of the business sectors, strikingly in new advancements. Crypto stage Coinbase (COIN), in the mean time, has lost 45% in market esteem in the previous month. Crypto-uncovered organizations like PayPal (PYPL), Robinhood (HOOD), and Block (SQ) have lost significant worth as of late also.

Global Ladies’ Day Nasdaq President Adena Friedman on propelling ladies to the C-suite

Global Ladies’ Day Nasdaq President Adena Friedman on propelling ladies to the C-suite  Why Dallas Ranchers Lobby of Notoriety QB Troy Aikman is taking on Enormous Brew

Why Dallas Ranchers Lobby of Notoriety QB Troy Aikman is taking on Enormous Brew  Young ladies Who Code pioneer ‘Working environments have never been worked for ladies’

Young ladies Who Code pioneer ‘Working environments have never been worked for ladies’  Robinhood dispatches check card that allows shoppers to utilize loose coinage to contribute

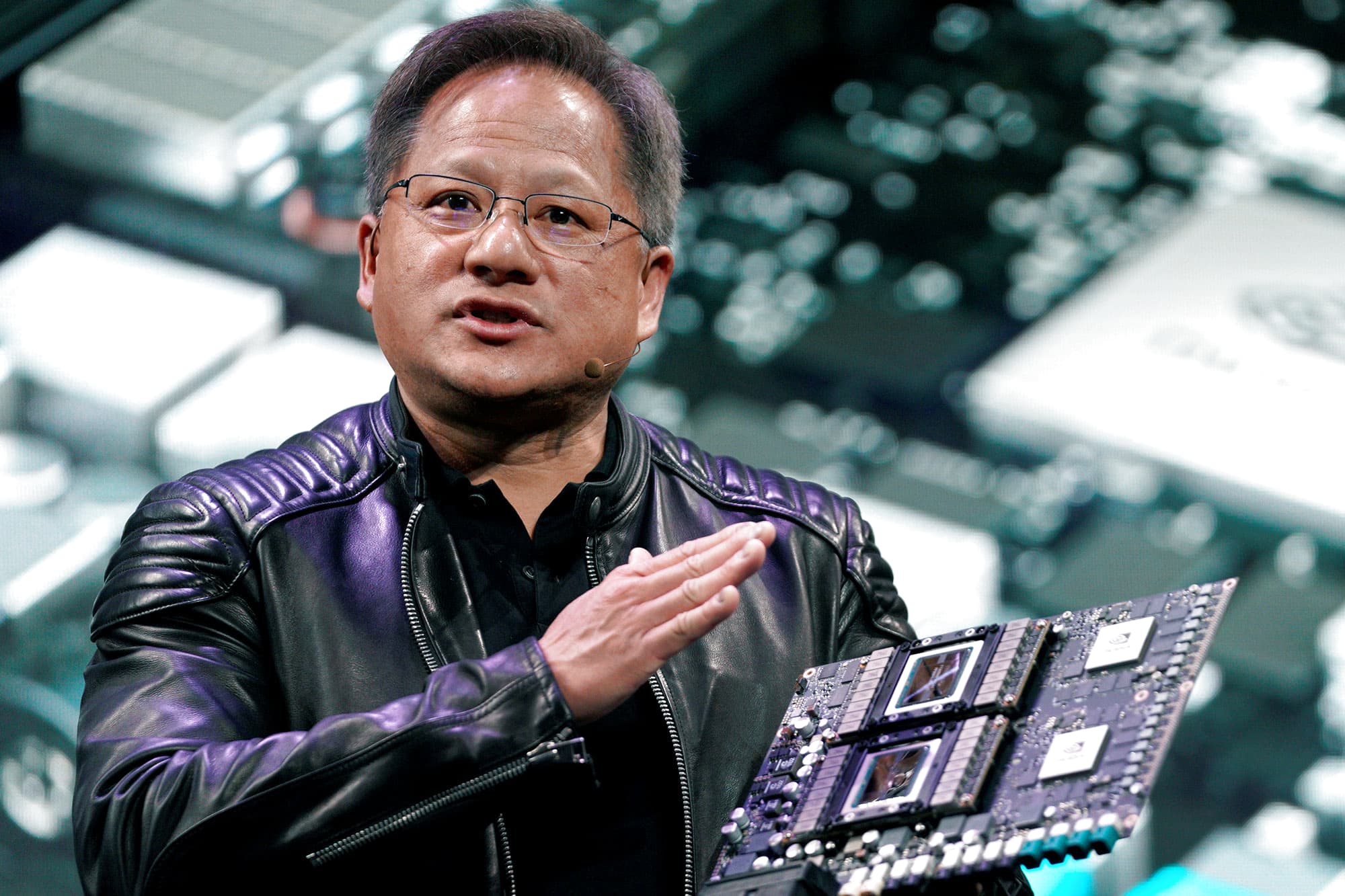

Robinhood dispatches check card that allows shoppers to utilize loose coinage to contribute  Why Nvidia’s Chief sees auto chips and tech as the organization’s next huge business

Why Nvidia’s Chief sees auto chips and tech as the organization’s next huge business  Nvidia President Jensen Huang Our Effortlessness computer chip

Nvidia President Jensen Huang Our Effortlessness computer chip